TLDR: Over the last year, the venture industry has stratified into AI and DeepTech with 66% of all VC dollars deployed evenly into both. Everything else is down 63%.

I have a few charts for you.

I came across a dealroom.co report last week, and then of course Bond Cap released 340 slides on Trends in Artificial Intelligence.

I couldn’t possibly unpack the whole thing with 30 minutes until I hit publish, so you may want to bookmark it for yourself or upload it to ChatGPT for analysis.

But, there are a few interesting things I wanted to highlight this morning.

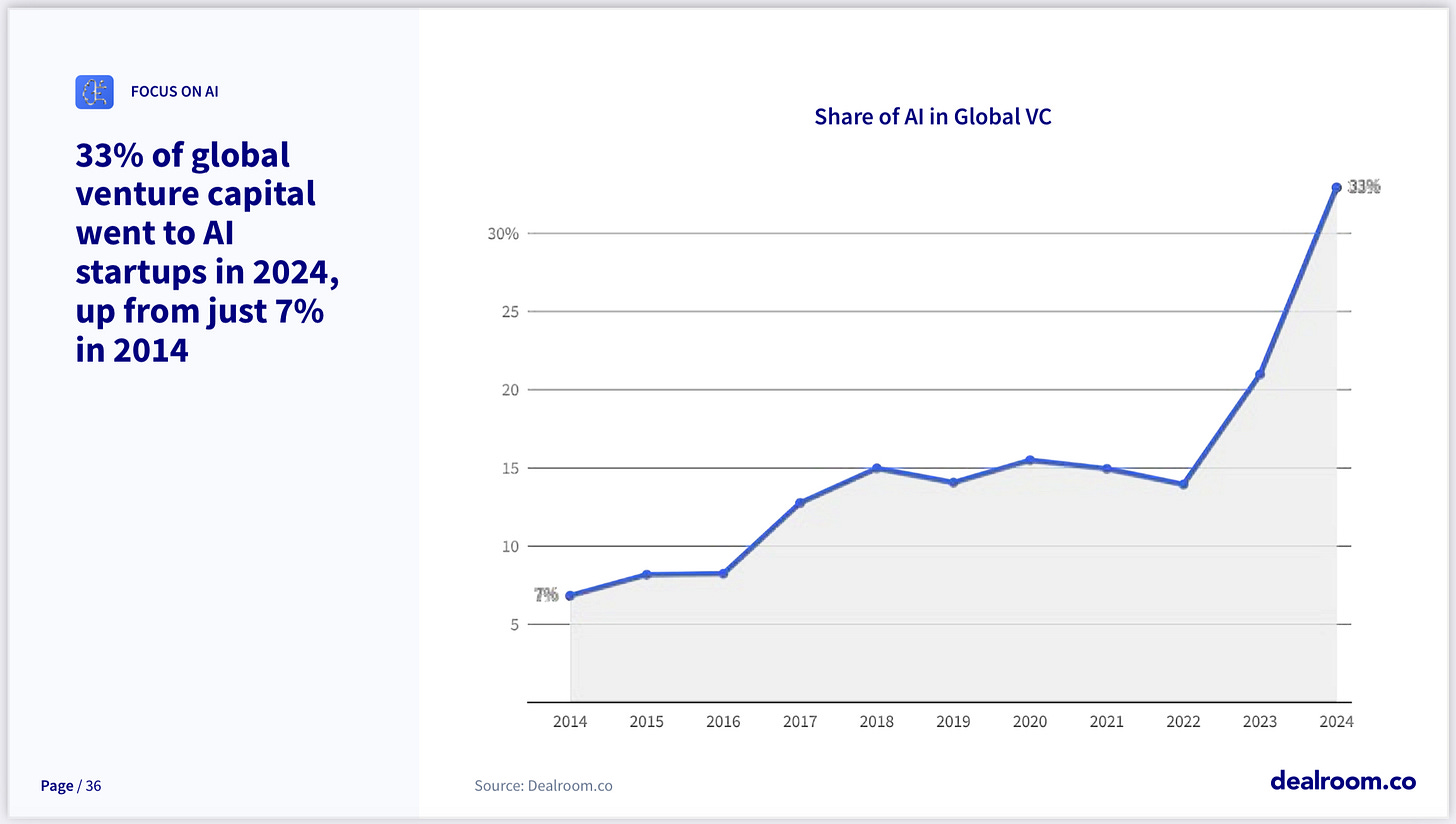

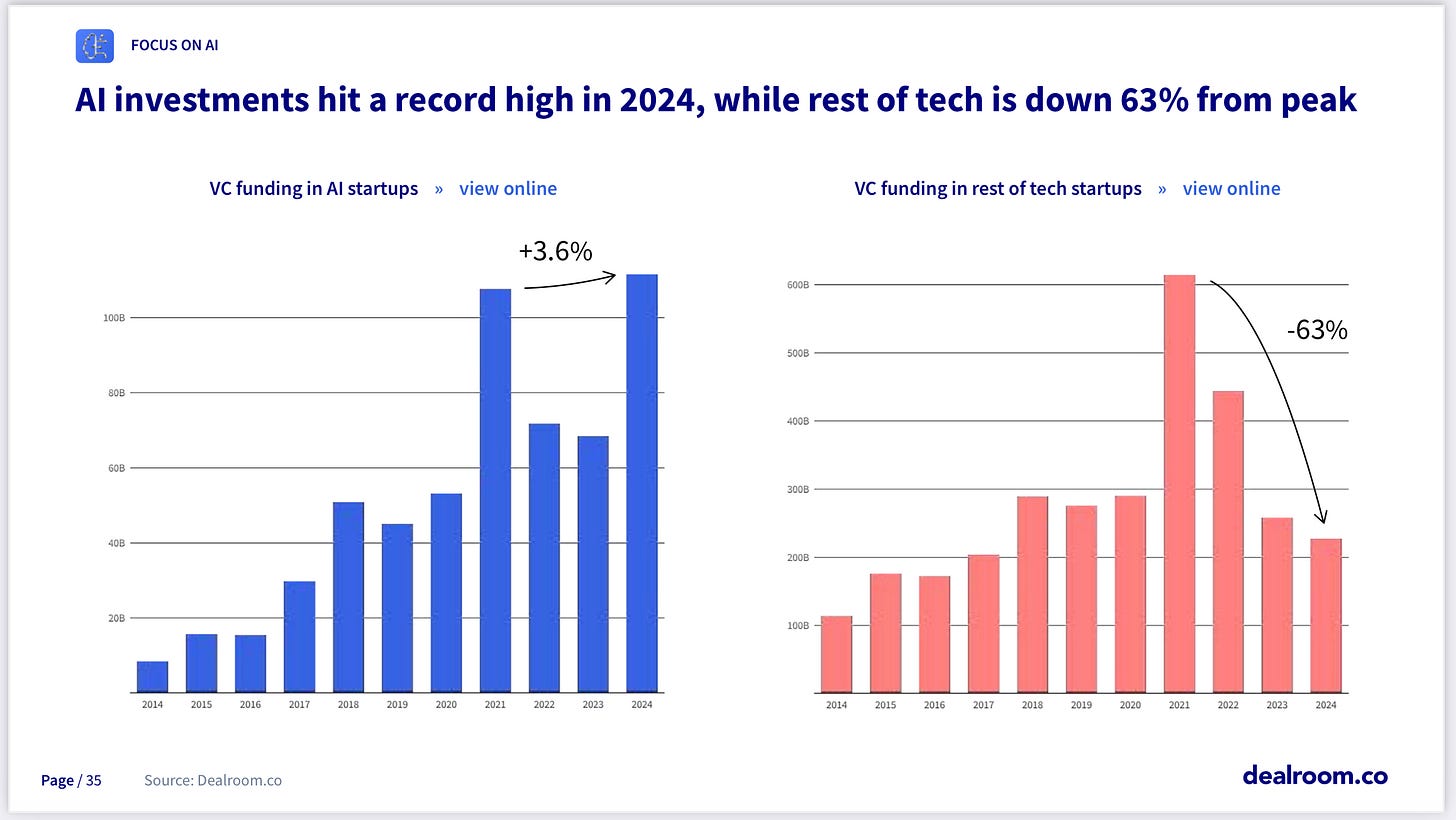

First, the VC market has become stratified into AI and DeepTech.

33% of all venture capital went to AI in 2024, and 33% went to DeepTech.

On the one hand, AI is creating more leverage than ever, companies are scaling faster than ever (below), doing it with fewer people than ever, and all while requiring less cash than ever. Then, on the other hand, we have these mega funds that need to deploy capital.

How do you reconcile the two?

Well, I think you have to fund companies that can consume, deploy, and return billions.

And that predominately exists either in hardware or blitzscaling.

You’re either funding things like data centers, robots, rocket ships, underwater drones, hydrogen exploration, and home builders, or you’re funding companies that can hire people and spend marketing dollars at breakneck speed.

Unsurprisingly, the rest of tech is down 63% from the peak.

So let’s talk blitzscaling and deeptech.

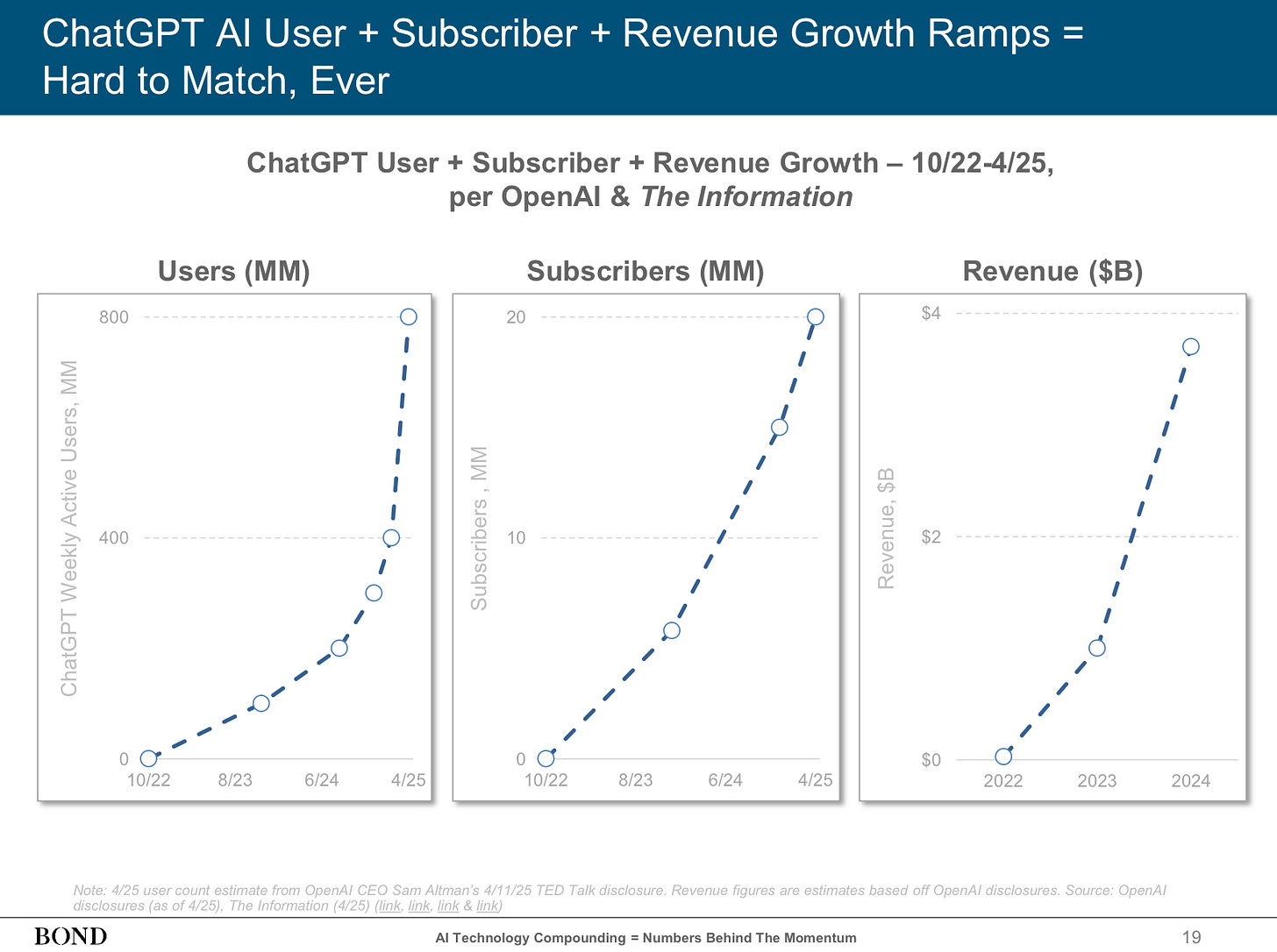

If you open up that Bond Cap report, you’re going to find a lot of hockey sticks. I’m talking AI usage, model capabilities, energy consumption, NVIDIA developers, etc etc etc. But below is probably the most eye-popping example.

ChatGPT has over 800 million users, over 20 million subscribers, and nearly $4B in annual revenue. All since 2022.

Absolutely absurd.

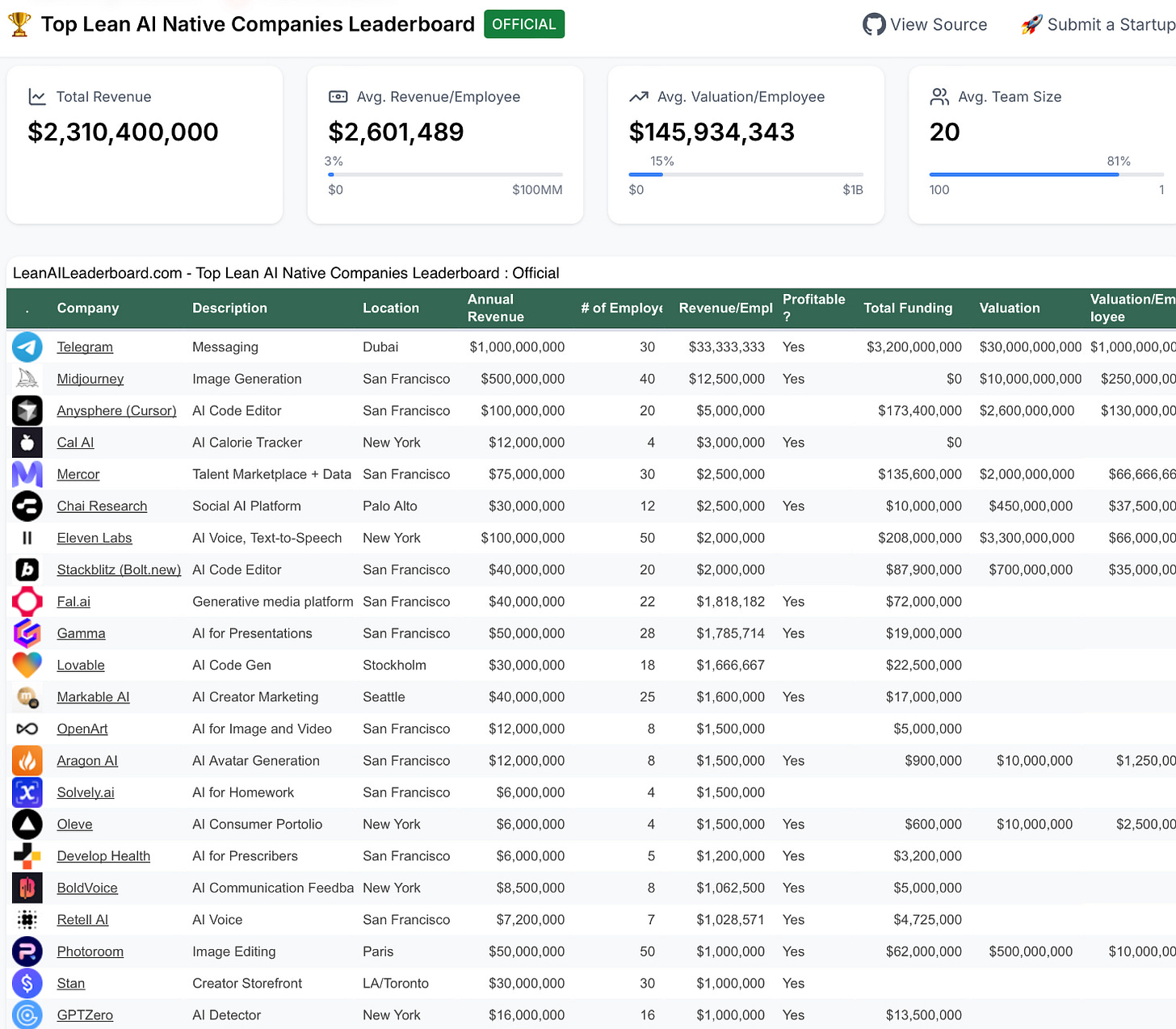

And if you think that’s an anomaly, it’s not. There are many more companies on insanely steep trajectories. Look no further than the Lean AI Leaderboard.

These companies are doing 7-10 figures in revenue, and they’re growing so fast the dashboard can’t even keep up. Look no further than Lovable, reported at $30m ARR here, but the founder is public on LinkedIn stating $60m ARR growing at 10% per week. Per week!

Absolutely absurd.

And yes, AI is cool, and growing fast, but it’s not the only thing that is changing massively.

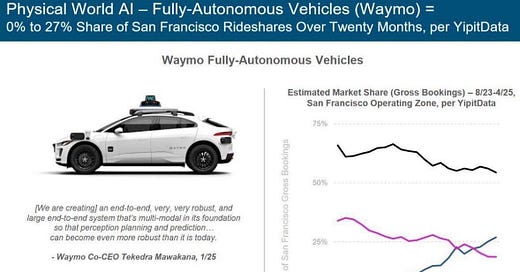

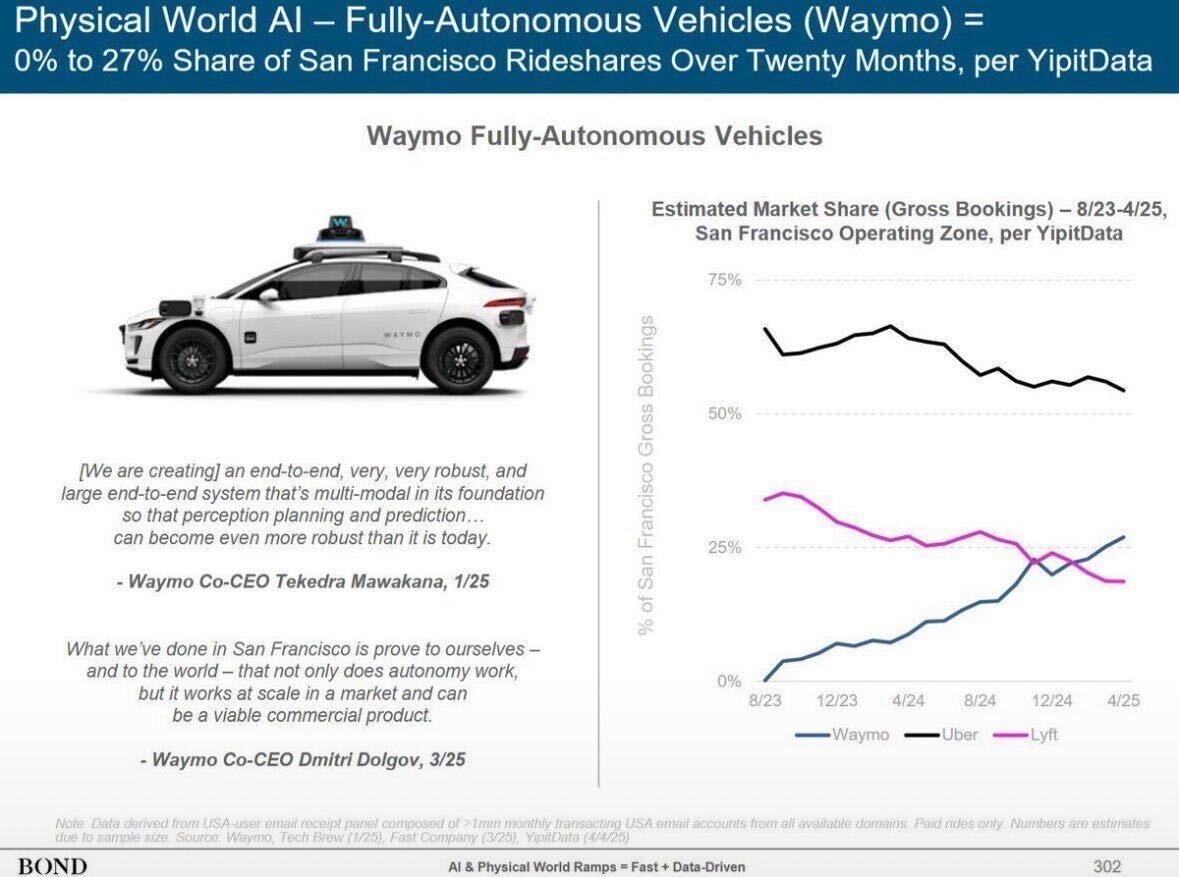

Look at Waymo’s self-driving cars for example, below.

Waymo has already surpassed Lyft in San Francisco ride share bookings. And, it’s on pace to eclipse Uber within the next year too.

We have known this is coming, but now it’s here.

If you think your kids will be driving their own cars, think again.

But this isn’t the only crazy thing happening in the hard industries.

I say “hard” because these industries were traditionally hard to fund. They took too long to achieve scale in a world where VC funds had a 10-year lifetime. But the mega funds are RIA’s now, they can hold companies forever if they choose to.

Not only has that time horizon requirement lifted but the capital requirement has exploded. And, like Tesla and SpaceX, the asymmetry in the upside is unprecedented too.

Imagine replacing every car in the world. Now imagine every lawn mower. Every boat. Every… single thing that moves.

Machine perception is here.

But it doesn’t end there.

We’re sending rockets to space, and using excess compute on satellites for remote data centers. We’re building homes in factories, ridding the world of disease-carrying mosquitos, building new commercial airliners and inventing new electric boats, we’re detecting cancers at ‘stage 0,’ decentralizing biobanks, extending the healthspan and lifespan of living organisms (like dogs) with FDA-approved therapeutics, alleviating cardiovascular disease, and those are just companies my team has invested in.

Now think about the entirety of the industry. The entirety of the world.

Now think about that first point again:

There was as much money invested in AI in 2024 as there was in DeepTech.

The world is changing, and it’s changing faster than ever before.

See you Monday.