TLDR: Mega funds aren’t bloated—they’re built to follow winners and deploy at scale in a world of trillion-dollar outcomes. Venture is consolidating into platforms, specialists, and studios.

For the past few years, there’s been a dominant narrative in venture circles:

“Mega funds are just asset gatherers. $20B+ is too big to return. They’re optimizing for management fees, not performance.”

And I agreed for a while, but I’ve changed my mind.

That take assumes they’re blind. Or greedy. Or stupid. But we’re talking about some of the most sophisticated and successful capital allocators to ever play the game. What if we’re looking at it backwards?

Let’s flip the question:

What would need to be true for mega funds to be the optimal model for the next era of venture?

The Case for Mega Funds Comes Down to Three Things:

1) Follow Your Winners

This is the core truth of venture: outliers matter more than averages.

Think of it like the S&P 500. You don’t need to beat the market—you just need to stay long the winners. The rebalancing effect does the rest.

In venture, your pro rata rights scale with the success of your companies. The best investors don’t just “get in early,” they keep buying in as companies earn the right to more capital.

Take Sequoia and NVIDIA. They bought ~30% in 1993. Now imagine they held 30% of a $1.1 trillion company, that’s $330B. Even just 10% is $110B. That’s a 5.5x return on a $20B fund… from one position… with $220B still in play!

You don’t have to sell. Especially if you’ve changed your regulatory status and can trade public stocks—you can hold through the power law. And, if you’re managing permanent capital—like pensions or sovereign wealth funds—the pressure for liquidity is much lower than traditional high net worth LP’s.

For a mega fund to return $XXB, they would need to be able to fully maximize their follow-on strategy and maintain their ownership in the outliers.

2) Bet on More (and Bigger) Winners

In 2013, there were about 100 unicorns globally.

Today? Over 1,300. Yes, many are overvalued. Yes, many won’t make it. But look around:

Uber

Airbnb

Snowflake

Stripe

ServiceTitan

Databricks

OpenAI

Canva

These aren’t flukes. They’re decacorns, and they’re scaling into $50B–$200B territory. The curve is bending up and to the right.

Mega funds aren’t betting that companies will IPO at $1B. They’re betting that a new class of private giants will emerge—and that those giants will need massive amounts of capital.

3) Innovate How Capital Is Deployed

Today’s mega funds are no longer just early-stage equity players. They’ve evolved into private market platforms:

Crossover capital into growth rounds

Credit strategies, like GC’s Customer Value Fund

Revenue-based financing, structured equity, secondary liquidity

And these strategies sit at the nexus of what is good for founders and what is good for LP’s:

Repeatable (good companies want it again)

Non-dilutive (founders love it)

Uncorrelated with exit markets (LP’s realize returns)

These are tools, not gimmicks. They give funds more optionality, lower dilution, and repeatable deployment mechanisms.

If you want to deploy billions intelligently, you need to be able to create optionality in your exit strategy and new ways of liquidating to return capital to LP’s.

The Emerging Venture Archetypes

Zoom out, and you can see a consolidation happening. The venture world is starting to cluster into five durable firm models:

1) Inception Stage Platforms

Antler, YC, FJ Labs, SV Angel

High volume

Max variance

Deal creation, top-of-funnel gravity

2) Niche Power Law Hunters

Precursor, Wischoff, «Emering Manager Fund I»

Sub-$50M

Deep theses

High signal, high conviction

3) Multi-Stage Mega Funds

Sequoia, a16z, Insight, General Catalyst

Massive capital

Full-stack lifecycle investing

Platform value beyond money

4) Idea to IPO aka Studio Funds

Atomic, Alloy (High Alpha)

Founders-in-residence

Control + concentration

Repeatable creation

5) Cash Flowing Tiny-Tech PE

Constellation (Mark Leonard)

Profitable software

Hold + compound

Efficiency > blitzscaling

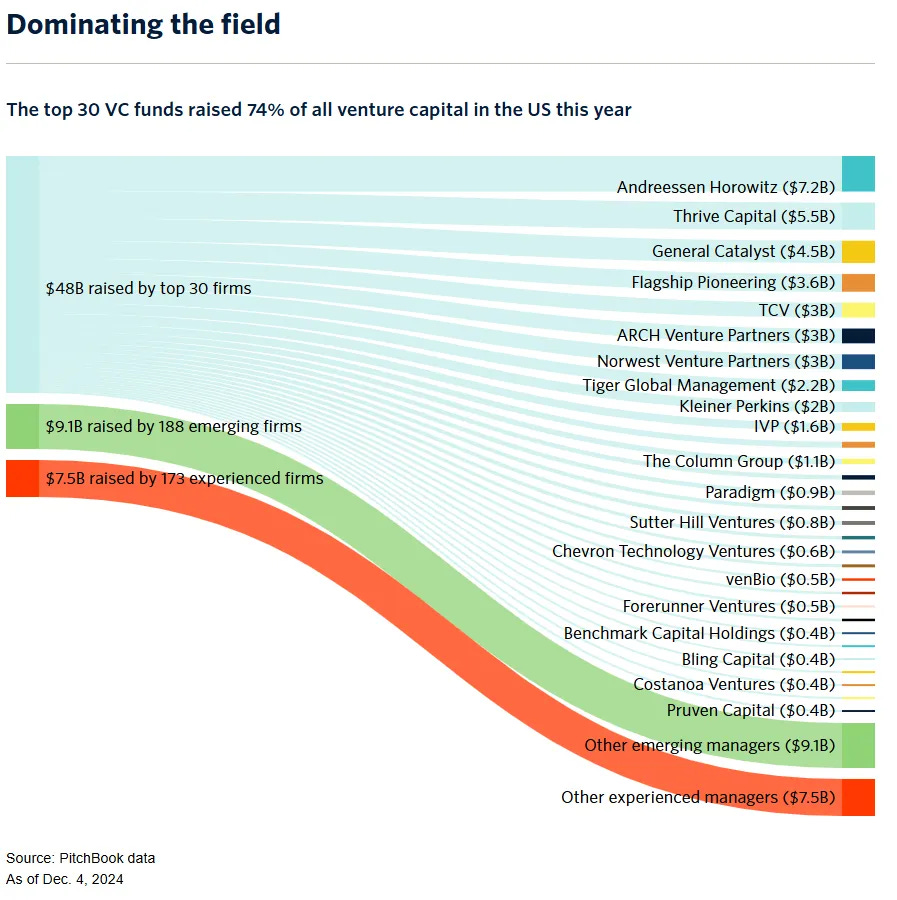

Visual Evidence: Capital Is Consolidating

This chart says it all.

The top 30 VC funds captured 74% of all US venture capital raised in 2024. That’s $48 billion across just 30 firms.

Meanwhile, 361 other firms (both emerging and experienced) split the remaining ~$17B.

The game is concentrating.

If you can deploy well at scale, you win.

If not, you specialize or go early.

Final Thought

The best venture firms of the next decade, regardless of model, will do three things better than venture has ever done them before:

Follow their winners

Believe in, and bet on, bigger outcomes

Innovate how they deploy capital

Mega funds aren’t broken. They’re built for this new frontier.

What looks bloated from the outside might actually be a scaled-up machine, built to ride the next generation of power laws.

See you Monday.