TLDR: What if you could diversify your fund enough to raise the downside to 2-3X while retaining the concentration needed to be a top 5% fund?

For a few years now, I’ve been making the case that traditional early stage investing is broken.

Primarily, because the average human investor is not good at predicting the future, and because the standard early stage fund model doesn’t account for that fact in either diversification or follow-on reserves.

Rather than just saying that though, I’ve been trying to bring actual numbers to the forefront more recently to better make the case.

From developing an equation for systematic alpha…

Alpha = Entry Price/FTR - Avg. Follow-On Valuation

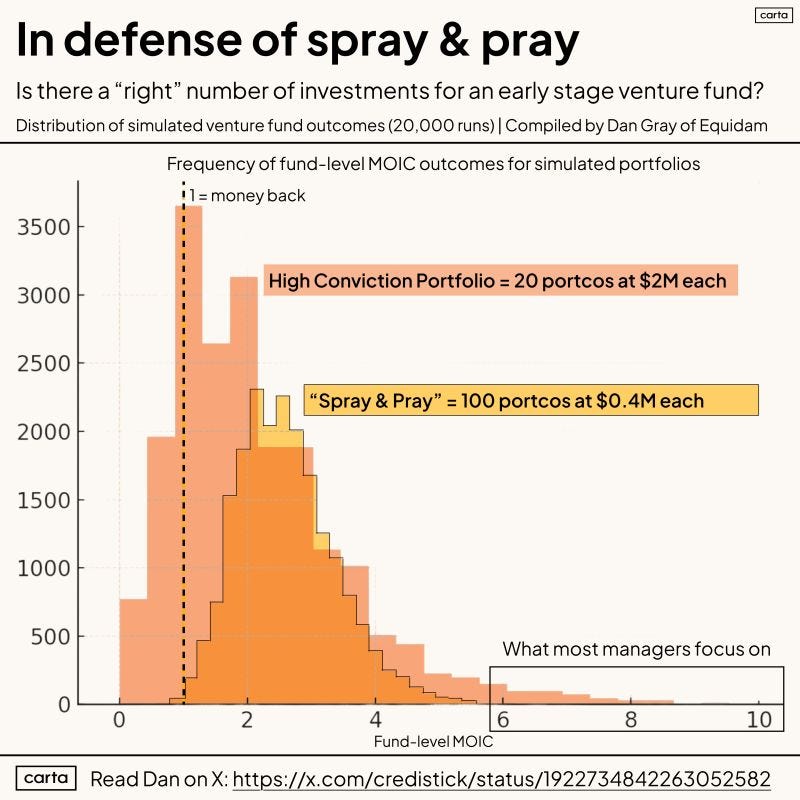

To showing the Monte Carlo simulations that demonstrate how much better your odds are of catching Power Law with a $10B mega winner by increasing diversification…

And while I’m still an amateur investor—and I think anyone under 10 years probably should consider themselves one—it seems like many more are starting to catch onto this fact.

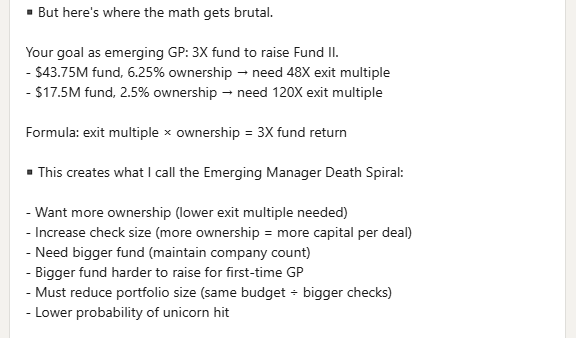

Here’s Pavel Prata on the early stage fund math:

You can click the image to go deeper on the analysis of $15m, $25m, and $40m fund models. But I will save you the time, the math isn’t pretty:

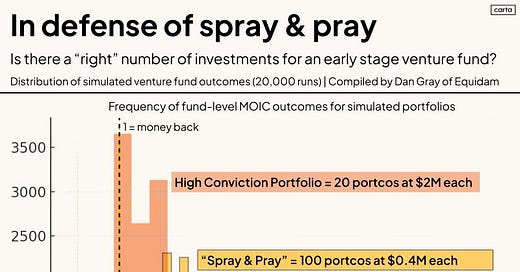

And the narrative continues to sweep through the industry, as Dan Gray from Equidam & Peter Walker from Carta shared a similar sentiment “In defense of spray & pray” where as Dan puts it:

“If you are a top 5% fund, concentration wins. If you’re not, diversification wins.”

In the post, Peter goes on to show their work, where the chances of achieving >2X are far greater (77%) with a diversified portfolio than with a concentrated one:

The real bogey here though is the ability to follow-on and create concentration in your portfolio.

What if you could have a diversified funnel, reducing your downside risk, or as the post above shows, increasing your probability of >2X to 77%, while also maintaining the upside of a concentrated portfolio? How would you even do that?

Well, the answer exists in two parts:

Systematic follow-on. The real issue that both Pavel and Peter’s posts ultimately arrive at, is that both emerging managers and diversified portfolios struggle to get either enough ownership or enough concentration through follow-on investments. The answer is to have both a large enough fund, and a systematic strategy to follow your winners, rebalancing like the S&P 500 does.

Pro rata protection and further concentration. Beyond that first round of follow-on financing, the diversified fund needs to be able to continue following it’s winners. Though the systematic follow-on increases ownership from ~7% to ~11% (think YC’s MFN, or Antler’s ARC), the second follow-on needs to protect pro rata and reduce the immediate and steep dilution cliff. This is actually much harder in the industry than the legalese would suggest, and occasionally, there are mega rounds, where the big mistake is to sit out because it seems too expensive, as Peter Thiel recounts Facebook’s Series B.

Though as Pavel points out, it’s hard for emerging managers to raise large enough funds for proper diversification with meaningful ownership through follow-on, he, Peter, and Dan, all point out that diversification is a fundamental advantage in early stage investing.

If you can tie that together with enough capital and the right follow-on strategy, then you may just be onto a fund model that both raises the downside risk to >2X while retaining the upside of a concentrated top 5% fund.

That is of course if the mega funds don’t fully take over.

My bet however is that the industry remains fairly bifurcated between deal and valuation creation, where deal creation is about inception—highly diversified vehicles and institutions that give founders a real chance to build teams, build product, raise capital, and find customers, while value creation is about mega funds anointing winners and following-on for 20+ years in search of the next trillion-dollar outcome.

Both fund models need each other.

One is entrepreneurship as infrastructure and the other is platform as a service.

See you Monday.