TLDR: Universal Data Income (UDI) is a proposal to profit share from the $10.5 trillion data economy, disrupt tech monopolies, and redistribute wealth. UDI could supplement incomes globally, bridge wealth gaps, and foster innovation—paving the way for a fairer digital future.

Imagine this: every tap, click, and swipe you make online generates value—but not for you.

Right now, tech giants are raking in billions by monetizing your data, while you get nothing in return except hyper-targeted ads.

What if that changed?

Universal Data Income (UDI) is idea that would give individuals ownership over their data’s value and open the door for founders to disrupt trillion-dollar incumbents with a better, fairer system.

What Is Universal Data Income?

Universal Data Income is about flipping the script on how data gets monetized. Think about it: every time you shop online, stream a movie, or use a navigation app, you create a digital footprint. Today, that data powers industries worth trillions of dollars. Companies like Google and Amazon turn it into revenue, but the people generating it—us—are left out of the equation.

Consider this: during the Industrial Revolution, factory workers fought for fair wages as their labor fueled economic growth. Today, data is the new labor, and UDI is the equivalent of demanding fair pay for your contributions to the digital economy.

According to a PwC report, AI could add $15.7 trillion to the global economy by 2030, much of it fueled by data. Factoring in digital ads, IoT, healthcare, autonomous systems, and AI training, the value of data sharing is estimated to exceed $10.5 trillion annually, accounting for approximately 10% of the global economy (Visual Capitalist, Allied Market Research).

Universal Basic Income vs. Universal Data Income

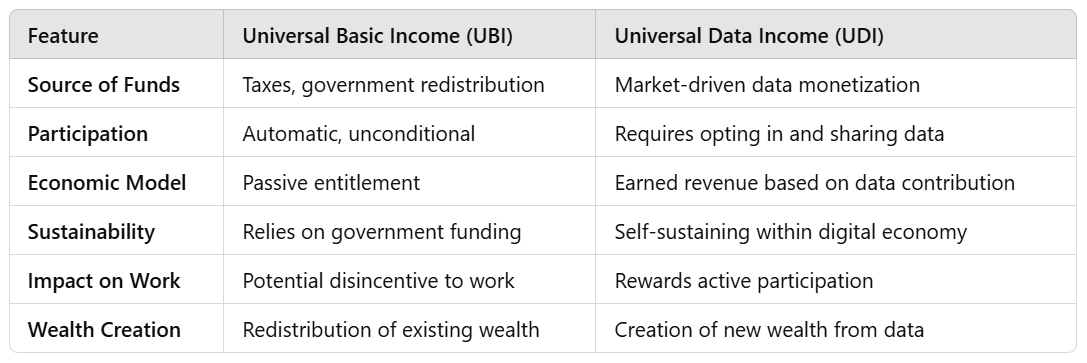

Universal Basic Income (UBI) and Universal Data Income (UDI) both aim to address economic inequality and create financial security. However, while UBI relies on government redistribution, UDI is a market-driven solution that compensates individuals for the economic value of their data.

As AI agents increasingly automate jobs, it's critical to take UDI seriously.

The two key drivers of AI innovation are algorithms and data. While China’s centralized approach provides researchers with vast datasets, albeit open sourced in the case DeepSeek’s R1, the USA and EU remain hindered by fragmented data silos.

How can a Western system that values user privacy and digital property rights compete?

The answer lies in capital markets for data—systems that enable secure data exchange while ensuring fair compensation for contributors. By leveraging capitalism and digital property rights, we can outcompete centralized models and build a more innovative, privacy-respecting AI ecosystem.

Example

DLP Labs is building a Data API to enable UDI. They help individuals sell subscriptions to their car's data, with the long-term vision of building a generalized product to allow individuals to convert shopping, hardware, and demographic data into a revenue generating asset.

McKinsey estimates each car generates up to $600+ of data per year ($250B TAM) to help battery makers, OEMs, insurance companies, and advertisers with R&D and cost savings.

Pretty simply, if you’re the driver, you should receive a share of that. That monthly payment could partially offset the cost of insurance, gas, or simply reduce the cost of ownership.

Why UDI Is a Massive Opportunity for Founders

Tech monopolies dominate today because they’ve built empires around user data. But history shows us that disruption is inevitable. Netflix outpaced Blockbuster. Shopify challenged Amazon’s dominance. The next wave of disruption could focus on decentralizing data ownership.

Here’s why UDI represents a goldmine for founders:

New Business Models: Platforms that pay users for their data could redefine entire industries. Imagine apps where users are compensated directly instead of being the product. Think of it as Airbnb, but for your (anonymized) data.

Leveling the Playing Field: By offering transparency and financial benefits, UDI startups could pull users away from established tech giants. Disruptors with innovative UDI models could become the next unicorns.

Addressing AI’s Economic Impact: AI is expected to displace 85 million jobs by 2025. UDI offers a new income stream tied to a universal resource: personal data.

Global Reach: New infrastructure and platforms enabling UDI aren’t constrained by borders. The global population is generating more data than ever, offering endless market opportunities for savvy entrepreneurs.

UDI Potential is Growing Rapidly

To illustrate the opportunity, here’s how the annual value of user data evolves with a 14.5% CAGR (Compound Annual Growth Rate) over 1, 5, and 10 years.

How These Dollar Amounts Impact Individuals

Even if the dollar amounts seem modest relative to the size of the data economy, they become transformative when distributed across billions of users:

North America: A user could earn $262 in Year 1, rising to $820 by Year 10. This income could help offset annual household expenses or cover subscriptions.

Europe: Users earning $196 in Year 1 and $610 by Year 10 could use this supplemental income for rising utility or education costs.

Asia-Pacific: The Year 1 value of $118 scaling to $368 by Year 10 could fund education or community projects in developing regions.

Emerging Economies: In regions where $79 in Year 1 represents a meaningful percentage of annual income, the $245 payout in Year 10 could support healthcare or basic even basic needs.

These payouts demonstrate UDI’s potential to redistribute wealth globally, narrowing inequality and fostering economic resilience.

UDI as a New Corporate Tax Model

Governments have long relied on corporate taxes to fund public services, and many have argued for Universal Basic Income (UBI), but UDI offers a more direct alternative. By requiring companies to share profits from data monetization with users:

Direct Redistribution: Instead of corporate taxes funneling through federal systems, UDI would empower individuals directly, making data contributors immediate beneficiaries.

Participatory Incentives: Unlike traditional taxation, UDI encourages participation. Users only earn payouts if they consent to share their data, creating a voluntary, opt-in model.

Enhanced Accountability: By creating transparency in how data profits are shared, UDI ensures companies remain accountable to users, fostering trust and fair practices.

Why UDI Matters for Society

Beyond its economic impact, UDI represents a cultural shift in how we think about technology and fairness. Here’s what’s at stake:

Economic Inclusion: For billions of people, UDI could mean fewer hard choices between food and rent. By turning data into income, we create a more inclusive digital economy.

Bridging Wealth Gaps: The current system enriches a handful of companies. UDI redistributes that wealth, ensuring tech progress benefits everyone.

Catalyzing Innovation: With more disposable income, individuals could invest in education, health, and entrepreneurial ventures, creating ripple effects across industries.

Redefining Privacy: By giving users control, UDI shifts the narrative from exploitation to empowerment, setting a new gold standard for ethical tech practices.

Environmental and Economic Sustainability: A balanced redistribution of wealth could foster long-term economic and environmental sustainability, addressing systemic inequalities at their root.

UDI Wasn’t Possible Before, But it is Now, Thanks to Blockchain

The concept of Universal Data Income isn’t new, but its execution was previously impossible. Three core challenges prevented UDI from becoming a reality:

Data Privacy & Security: Personal Identifiable Information (PII) needed to be abstracted before data could be transacted without exposing user identities.

Seamless Transactions: Monetizing data efficiently at scale required an infrastructure to handle billions of micropayments in a trustless way.

Participation Incentives: Users needed a reliable way to opt in, control their data, and receive frictionless payouts.

Blockchain solves all three. Zero-Knowledge Proofs (ZKPs) allow individuals to verify and monetize their data without revealing personal details. Smart contracts ensure that payments are distributed transparently without intermediaries. Decentralized transaction networks allow seamless, automated payments based on real-time participation.

For the first time in history, we have the infrastructure to track, price, and pay out data value at a global scale—all while maintaining privacy and security. This isn’t just a vision. It’s an execution play that is ready to be built.

UDI and the Rise of DePIN

Universal Data Income aligns with Decentralized Physical Infrastructure Networks (DePIN), which are redefining how infrastructure—from compute power to wireless networks—is owned and operated. Instead of corporations monopolizing these resources, DePIN enables individuals to contribute, operate, and monetize decentralized infrastructure.

According to the State of DePIN 2024 Report, the sector secured over $1 billion in funding in 2023 and is expanding rapidly across decentralized compute, storage, and AI-driven networks:

Compute & AI Infrastructure – Demand for decentralized compute surged, leading to a 30x increase in revenue, as AI companies sought scalable, distributed processing power.

Storage Networks – Decentralized storage processed over 1 exabyte of data, competing with traditional cloud providers.

Wireless Networks – Projects like Helium have deployed over 1 million nodes, demonstrating that decentralized infrastructure can scale globally.

Just as DePIN decentralizes infrastructure ownership, UDI decentralizes data ownership. Both models shift control from corporations to users, ensuring individuals directly benefit from the value they create. By integrating UDI with DePIN, we enable a future where users not only own their data but also participate in the networks that power the next generation of AI, cloud, and wireless connectivity.

Challenges to Overcome

While UDI has immense potential, it’s not without obstacles:

Valuation Complexity: Not all data is created equal. Healthcare data might be worth hundreds of dollars, while browsing history is worth pennies. Creating fair pricing models will be critical.

Global Standardization: Governments and corporations need to align on frameworks. Without cooperation, the system could fragment.

Privacy Risks: Monetizing data must not come at the cost of user privacy. Safeguards will need to evolve alongside UDI platforms.

In Summary

Universal Data Income isn’t just a financial mechanism—it’s a reimagining of how value flows in the digital economy. By redistributing wealth generated by data, UDI offers a path to a fairer, more inclusive, and innovative future.

This shift is already underway. Companies like DLP Labs are pioneering decentralized models where individuals can monetize their data while preserving privacy. The foundation is set. The next phase is scaling this into the mainstream.

See you Monday.