TLDR: There’s no magic. I just did the job before I had the job. I forced my way into VC, and committed to working like a maniac for the foreseeable future. Do the job before you have the job.

Pretty often, someone wants to know how I got into VC.

For some reason, VC jobs have a brand of being elusive and desirable.

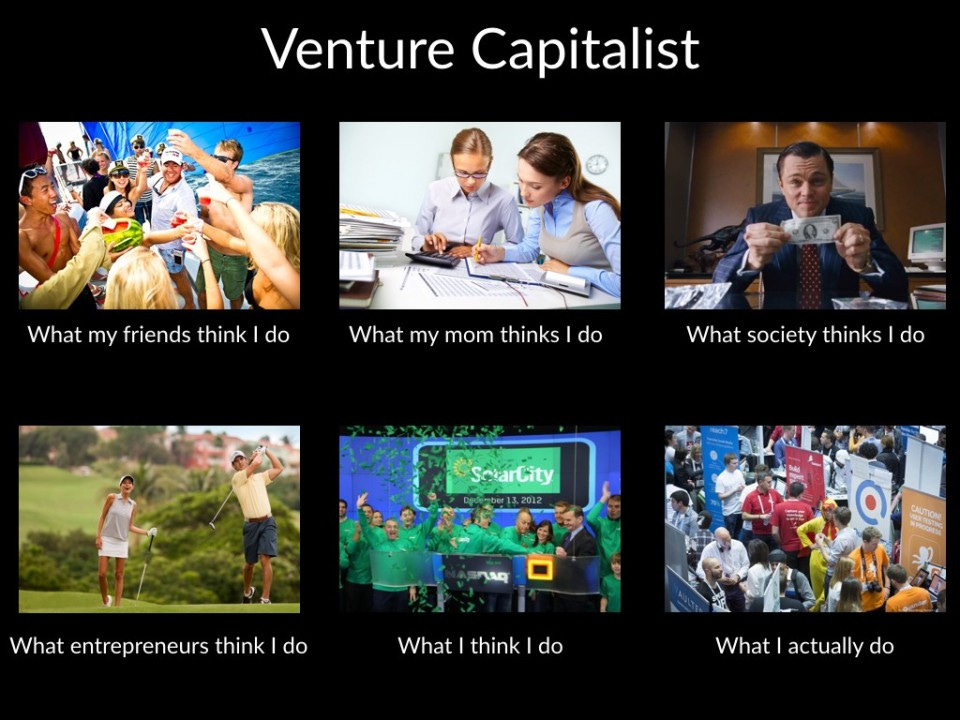

I probably should’ve taken five minutes and made my own version of this meme, but close enough…

The reality of what your career as a VC is really depends more on what stage of your career you’re in and what type of person your are.

To oversimplify it, there are four types of VC’s:

High volume, high work ethic

High volume, low work ethic

Low volume, high work ethic

Low volume, low work ethic

I probably should’ve taken the five minutes and drawn up the 2x2, but close enough.

Volume refers to the number of deals. Anything more than 5 or 10 deals a year led by a single partner is considered a lot in this game.

Work ethic refers to whether they’re in the trenches on the business of the fund and in the trenches with their founders’ companies. Most VC’s don’t evolve the business of the fund nor provide the value to founders they promise they will.

Hopefully it’s obvious, but the high work ethic buckets are where you want to be as a limited partner.

Success in the low work ethic bucket comes from a massive surface area of luck. Billionaires and athletes and people who have demonstrated enough work ethic in another area of their career that luck now finds them. Naval calls this “specific knowledge,” but in this case it also refers to specific powers like brand, distribution, etc.

Assuming you’re in the high work ethic bucket, it’s obviously an oversimplification, but you’re either going to be writing a lot of checks or not a lot of checks.

Conventional VC wisdom is 1) have enough diversification to find a winner, but 2) not so much diversification that you’re not concentrating into your winners.

This is true unless you get outsized ownership very early, like a studio, incubator, residency, or accelerator. In which case you’re even further down the risk curve and require dramatically more diversification. See the chart below.

Ideally you want at least 30 portfolio companies with enough reserves to concentrate into the best companies, but if you’re doing friends & family round stage investments, this number should be much higher. YC batches by comparison are 200-250 companies four times per year (although apparently their most recent Fall batch was only 50), suggesting that you can have hundreds or thousands of companies in a portfolio and still be shooting for Power Law returns.

I lay out this context because if you want to get into VC, you first need to decide if you have the work ethic—something most don’t realize is required from the outside looking in.

Second, you need to decide if you’re a low volume, high conviction type of investor.

The more you skew away from spreadsheets, research, competitive analysis, technical prowess, and industry expertise, the more you should consider the high volume high work ethic strategy where your focus should be more on talent, price, and diversification.

In my experience, this is what VC’s think they are:

5% - High volume, high work ethic

1% - High volume, low work ethic

90% - Low volume, high work ethic

4% - Low volume, low work ethic

But in reality, this is more my experience of what they actually are:

20% - High volume, high work ethic; there are many more emerging managers trying to make a name for themselves via funds and syndicates

0% - High volume, low work ethic; I rounded down, but this is just really rare, maybe an accelerator-level fund of funds for example

20% - Low volume, high work ethic; these are the good ones, the legendary ones who are high conviction and major value-add

60% - Low volume, low work ethic; this is the mainstream. Ask 10 founders how valuable their VC’s are, 9 out of 10 will tell you “not as valuable as they told me they would be”

You want to be in bucket 1 or 3. Here’s how I got into bucket 1.

I started by writing small checks. $1k - $5k.

I wrote 36 of them.

I took meetings with the GP’s and syndicate leads to understand their investment strategies.

I advised founders on the things I knew best — at the time, sales.

I did that for five or six years without getting paid to do it.

I learned the stages and VC industry.

I made an assessment of where I could create outsized value, and where I could play a game that I would be uniquely good at.

I took a massive pay cut to get into the industry full-time, trading cash for carry.

I wrote checks into the best founders I could find, and I worked endless hours responding to founders whenever they needed support.

As a result, I’ve been the first check into companies later backed by a16z, Accel, AlleyCorp, Benchmark, Craft, General Catalyst, Afore, Hyperplane, Khosla, CRV, Valar, and YC to name a few.

I’ve worked so closely with those founders that they will now send me deals and go to bat for me to win a deal.

There’s no magic. I just did the job before I had the job.

I forced my way into VC, and committed to working like a maniac for the foreseeable future.

The flywheel is always slow at first, but it moves a little bit faster with each push, and it gains a little more momentum each time.

Hard work, patience, and resilience.

See you Monday.